Residential property tax is the product of three numbers:

- The assessed value of your home

- The assessment rate and

- The total millage rate (mill levy).

The assessed value of the home is determined by the County Assessor, the assessment rate is set by the State of Colorado, and the mill levy is set by the County taxing authorities (schools, hospital, library, fire department, etc.).

Consider the property taxes for a house assessed at $500,000 in 2022. The State of Colorado’s assessment rate for 2022 was 7.15%. Assume an 80 total mill levy.

$500,000 * 0.0715 * (80/1000) = $2,860

Along comes 2023 and the assessed value of the home has increased by 50% to $750,000. The legislature has lowered the assessment rate in 2023 to 6.785%. They also provided a temporary $15,000 reduction in the assessed value. The 2023 property taxes are

($750,000 - $15,000) * 0.06785 * (80/1000) = $3,990

an increase of $1,130 from 2022.

The Polis proposition HH, on November’s ballot, would increase the temporary reduction to $40,000 and lower the assessment rate to 6.7%. The property taxes under proposition HH are

($750,000 - $40,000) * 0.067 * (80/1000) = $3,806

an increase of $946 from 2022.

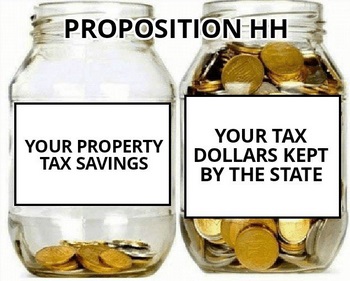

But here’s the catch! Under proposition HH, the difference between $1,130 - $946 = $184 would be taken out of the state’s TABOR surplus (backfill). You pay less in property tax, but the taxing authorities (schools, hospital, library) still get the benefit of increased property values (up to the TABOR limit). You pay a little less in property tax, but you give up your TABOR refund forever.

The other variables are fixed. The State of Colorado assessment rate is set by the legislature, constitutional amendment, or a referendum. In 2007, the legislature, under Bill Ritter, froze mill levy rates to prevent them from being lowered. In 2020, Colorado voters shot themselves in the foot by repealing the Gallagher Amendment, which had capped property taxes for both residential and commercial property.