Douglas County is moving in the right direction.

Douglas county commissioners approve 4% assessment reduction for single family properties.

Douglas County is moving in the right direction.

Douglas county commissioners approve 4% assessment reduction for single family properties.

I’ve written to the taxing authorities asking them to lower their mill levies in light of the 40% increase in property valuations. So far, two of them have told me the following:

Public entities that might receive a significant increase in tax revenue due to large increases in assessed property valuations, only applies to entities that are not subject to the Taxpayer Bill of Rights (TABOR) constitutional amendment, often referred to as “de-bruced” entities. However, two of the taxing authorities are not “de-bruced,” meaning it is subject to all the provisions of TABOR.

Under TABOR, which was approved by voters in 1992, there are limitations on how much tax revenue can increase as a result of higher assessed property valuations. Essentially, TABOR imposes a maximum annual percentage change in property tax revenue, which is calculated based on inflation in the prior calendar year plus annual local growth. Additionally, TABOR sets a strict 5.5 percent limit on property tax increases.

Some public entities, which are not subject to TABOR limitations or have been granted approval by their voters to “de-bruce,” have expressed interest in voluntarily limiting the windfall they receive from the substantial increases in assessed property valuations. These entities have more flexibility in managing their tax revenues compared to those subject to TABOR restrictions.

The South Library District (Salida’s Library) has been de-Bruced too. Here’s the answer I received from Matthew Burkley President, Salida Regional Library Board of Trustees when I asked.

“In response to your recent email, on Nov 7, 2000 the Chaffee County voters passed referendum 5A which allowed the library to “collect, retain and spend all revenues received from any source”. Please see the DOLA website for more information.”

Wow! What an obtuse answer. A simple yes or no would have sufficed.

Here are all the taxing agencies that have been “de-Bruced”. That is, they are not subject to the 5.5% limit on property tax increases as set out in TABOR. They can keep their mill levy at last year’s level and reap the taxes from the 40% increase in property valuations.

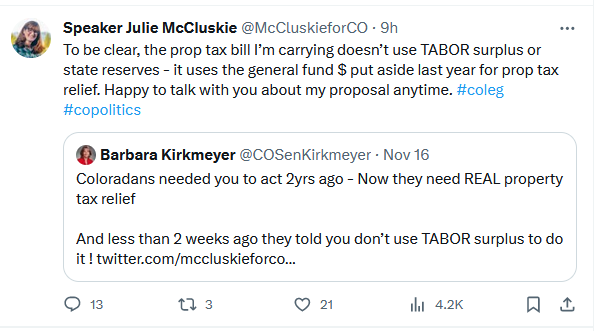

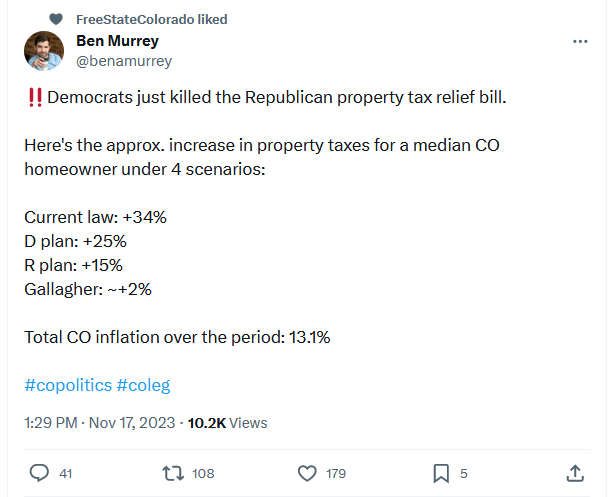

Looks like Julie is talking about using the general fund, and not TABOR. Ben is saying the Democratic plan offers some relief.

The Colorado Dems and Jared Polis want you to think they are saving you money after their Special Session. The truth is that their Special Session FAILED to provide meaningful property tax relief, and instead rewarded special interests, hijacked TABOR, and redistributed tax money.

Senate Bill 1, the primary vehicle for those efforts, would reduce valuations of all residential properties for the 2023 tax year by $55,000 and cut their tax-assessment rate from 6.765% to 6.7% for this year. After the bill passed both chambers on a purely partisan, Democrat-led vote, Gov. Jared Polis was scheduled to sign it into law at 5:30 p.m. Monday.

Since the State Legislature FAILED to provide meaningful property tax relief during the Special Session, it’s up to local governments to Lower the Mill Levy!

Your county, city, school and special districts CAN lower your property taxes!

Reach out to them now!

https://twitter.com/FreeStateColor1/status/1729890847674577111

This is how they do it in the Show me state!

For property Tax Year 2023, Kansas City and all of Jackson County, property owners were shocked with the dramatic increase in property tax assessments . The majority of the current assessments were in excess of 30% from the previous year, with many assessments increased by 100% or more. Along with the unrealistically high property assessments, the assessment notices were mailed late which resulted in reducing the allotted time a home owner could register an appeal. Additionally, the appeal process was convoluted and the assessor’s office was often unreachable.

This is how they do it in Colorado!

The Douglas County commissioners voted to lower property values in their domain by a mere 4% to help alleviate the sticker shock that’s coming when their constituents get their next tax bills, saving homeowners about $230.

The Colorado Board of Equalization slammed the door on Douglas County’s modest tax respite.

Lowering Douglas County assessed property values by 4% results in all of the local districts that rely on property taxes in the county receiving a little less of a massive tax increase. Except, not Douglas School District. Anything they don’t get from local taxpayers gets “backfilled” by the state.

And there’s the rub.

Salida Hospital District:

Last year the hospital district mill levy was 1.135, they are lowering it to 0.905, a drop of 20%.

They say the valuations in the three Counties were up 36.2%. (The tax they collect is proportional to the product of mill levy and the valuations.) Yet, they say that they are keeping inline with the 5.5% limit and allowance for growth per TABOR. Have the three Counties grown that much?

Buena Vista:

A resolution approving the mill levy certification of property taxes to Chaffee County for the 2024 budget. According to the resolution, the Town will levy a tax of 9.034 mills with a temporary rate reduction of 4.327 mills and an abatement credit of 0.001 for a total levy of 4.708 mills upon each dollar of the total valuation of taxable property within the Town. BV will also have to obey the TABOR restrictions.

Does anyone know the BV’s mill levy was last year?

Colorado Mountain College:

Last year’s mill levy was 4.085, but they will lower it to 2.977