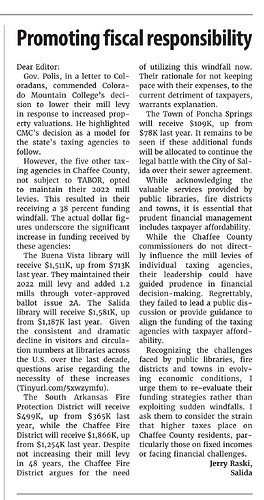

Today’s Mountain Mail

Special session of CO legislature passes further property tax reductions.

HB 1001 built on passage at the end of the regular legislative session of Senate Bill 233 — a $1.3 billion break that lowered assessment rates for residential and commercial properties and set a 5.5% annual growth cap for property-tax revenues going to local governments.

The new bill lowers residential assessment rates further — from 7.15% to 6.25% for property taxes going to local governments and 7.05% for those going to schools — and expands the new 25% assessment rate for nonresidential properties to include vacant land and state-assessed utilities. It also establishes annual property-tax revenue growth caps of 5.25% for local governments and 6% for schools, though it exempts new construction and revenues reserved for bond repayment and offers flexibility for local governments and schools to grow more after economically slow years.