Proposition HH raises multiple opinions

- by Brian McCabe Mail News Editor

- Sep 29, 2023

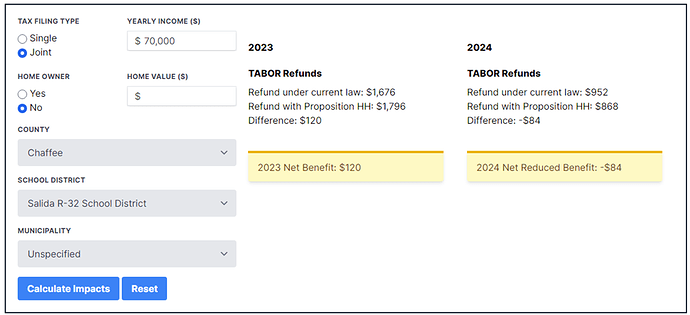

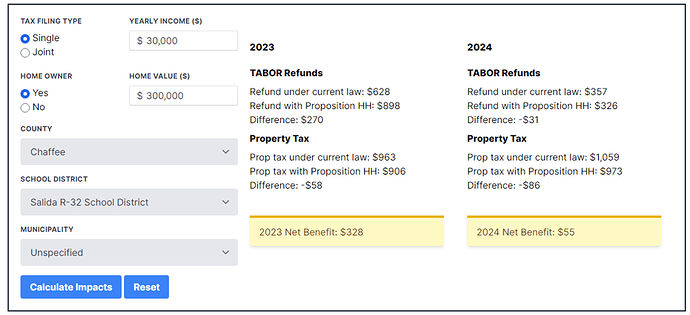

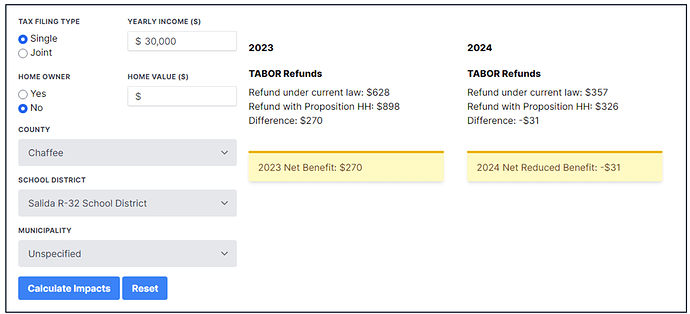

One of the questions voters will see on the Colorado ballot in November is Proposition HH, which asks, "Shall the state reduce property taxes for homes and businesses, including expanding property tax relief for seniors, and backfill counties, water districts, fire districts, ambulance and hospital districts, and other local governments and fund school districts by using a portion of the state surplus up to the proposition HH cap as defined in this measure?”

The state surplus the proposition refers to is money from the Taxpayer Bill of Rights, or TABOR, revenue limit. This limit is usually equal to the prior fiscal year’s limit, plus the rate of inflation and population growth. When the limit is exceeded, Colorado residents will receive refund checks. In 2022, the state sent out $750 in rebates to individual filers and $1,500 to joint filers.

Chaffee County Republicans released a statement encouraging voters to vote no on HH, stating it “promises short-term tax relief, but instead delivers long-term tax increases,” that it “guts TABOR protections, without holding an actual vote on TABOR,” and “rewards the State of Colorado for deceitful practices.”

Vince Phillips, a member of Chaffee County Republicans, said his problem with the ballot issue is that it is deceptive.

“Even if I thought it was a good policy, which I don’t, I wouldn’t vote for it, because it’s deceptive language. Not many people know what it is about, and we need to know what we are voting for.”

Phillips said when citizens submit an issue to be placed on the ballot, a board will write the language that appears, “so that language will be fair.” The Colorado Legislature, which submitted the proposition, writes its own ballot language.

“Proposition HH will invest in our local school district here in Chaffee County to give the kids here a great education,” JoAnne Allen, first vice chair of Chaffee County Democrats, said.

When asked about his position on Proposition HH, Colorado Gov. Jared Polis, a Democrat, said in an interview with the Denver Post, “Because of the very strong economy and very strong TABOR surplus, we are able to do both, we are able to not jeopardize or cut funding for our schools and provide important property tax relief today.”

Senate President Stephen Fenberg (D), also speaking to the Post, said, "That is the revenue that goes to support fire districts, to support libraries, to support schools. And that’s a core part of making sure that we do this responsibly, rather than just saying property taxes are too damn high, so let’s cut them and not think about the impact that has downstream to our local services.”

Some government officials and other entities, however, are against the proposition.

Fremont County officials, as reported by the Cañon City Daily Record, unanimously passed a resolution urging voter opposition to HH, using such language as “scam,” “shell game” and “convoluted piece of garbage.”

The Denver Gazette reported that the National Federation of Independent Business-Colorado asked its members, Colorado small-business owners, their thoughts on Proposition HH, and 90 percent said they were against it, 9 percent supported it, and 1 percent were undecided.

The Colorado Municipal League and the Colorado Special Districts Association have both come out opposing Proposition HH, along with Club 20, which represents businesses, individuals, tribes and local governments in Colorado’s 22 western counties.

Denver 9 News reported one committee was created to encourage voters to pass Proposition HH, called “Property Tax Relief Now.” This group has received money in the amount of $745,020, with donations from Gary Advocacy, a policy arm of Gary Community Ventures, the organization new Denver mayor Mike Johnson led before he was elected, plus philanthropist Pat Stryker, the National Education Association, the Education Reform Now Advocacy and Colorado Education Association.

Four different committees are against Proposition HH and have raised a combined total of $1,150,920. Some of their donors have included Defend Colorado, Advance Colorado Action, Americans for Prosperity and Boulder businessman Bill Witter, who stated to 9 News in a text, “I do think that the Colorado legislative majority and Gov. Polis are not transparently or honestly presenting to Colorado voters the likely long-lasting effects of HH if it passes in November. Measly temporary property tax ‘relief’ for permanent loss of TABOR refunds.”

For more information on Proposition HH, the Colorado information booklet on the upcoming election is now available online and can be found at https://leg.colorado.gov/sites/default/files/images/blue_book_2023_-_english.pdf.